2022 tax return calculator canada

Enter some simple questions about your situation and TaxCaster will estimate your tax refund amount or how much you may owe to the IRS. See how The New Equation can solve for you.

2022 Irmaa Brackets What Are They How To Avoid Irmaa

The period reference is from january 1st 2022 to december 31 2022.

. It all adds up to The New Equation. That means that your net pay will be 40568 per year or 3381 per month. 2022 Income Tax in Canada is calculated separately for Federal tax commitments and Province Tax commitments depending on where the individual tax return is filed in 2022 due to work location.

Province Select Province Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Québec. This calculator will help you get the net tax income after tax the percentage of tax of each government provincial and federal and all the contributions CPP and EI. The calculator reflects known rates as of June 1 2022.

For example in the 2021 tax season if you earn 80000 you will be in the 49020 to 98040 tax bracket with a tax rate of 205. This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available. 2022 Personal tax calculator.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. We can also help you understand some of the key factors that affect your tax return estimate. You can also explore Canadian federal tax brackets provincial tax brackets and Canadas federal and provincial tax rates.

Calculate the total income taxes of the Ontario residents for 2022. Use this calculator to find out the amount of tax that applies to sales in Canada. Our Income Tax Calculator for Individuals works out your personal tax bill and marginal tax rates no matter where you reside in Canada.

Enter the amount of your taxable income from line 260 of your return if it is 4528200 or less. If you get a larger refund or smaller tax due from another tax preparation method well refund the amount paid for our software. 2022 CWB amounts are based on 2021 amounts indexed for inflation.

Province or territory Select Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Quebec Saskatchewan Yukon. Use our simple 2021 income tax calculator for an idea of what your return will look like this year. 2021 2022 tax brackets and most tax credits have been verified to Canada Revenue Agency and provincial factors.

The results are only estimates however as various other factors can impact your tax outcome. If your taxable income is more than 4528200 enter instead the result of the following calculation. Amount from line 44 of your Schedule 1 divided by 15.

Youll get a rough estimate of how much youll get back or what youll owe. This marginal tax rate means that your immediate additional income will be taxed at this rate. British Columbia tax calculator.

Your average tax rate is 220 and your marginal tax rate is 353. Simply click on the year and enter your taxable income. Calculate your combined federal and provincial tax bill in each province and territory.

Personal tax calculator. Or you can choose tax calculator for particular province or territory depending on your residence. Calculate your combined federal and provincial tax bill in each province and territory.

Then select your IRS Tax Return Filing Status. TaxCaster stays up to date with the latest tax laws so you can be confident the calculations are current. Our free tax calculator is a great way to learn about your tax situation and plan ahead.

This means that you are taxed at 205 from your income above 49020 80000 - 49020. We are a community of solvers combining human ingenuity experience and technology innovation to deliver sustained outcomes and build trust. Canadian corporate tax rates for active business income.

The 2022 Canada Tax return is completed as one single calculation except Quebec with the total tax calculations tax credits and exemptions centralised to simply tax. Below there is simple income tax calculator for every Canadian province and territory. Use our free 2022 Canada income tax calculator to see how much you will pay in taxes.

2022 - Includes all rate changes announced up to June 1 2022. Calculations are based on rates known as of June 17 2022 including federal and provincialterritorial tax changes known at this time. You can also create your new 2022 W-4 at the end of the tool on the tax return result page.

Calculate the tax savings your RRSP contribution generates. TurboTax Free customers are entitled to a payment of 999. Claims must be submitted within sixty 60 days of your TurboTax filing date no later than May 31 2022 TurboTax Home Business and TurboTax 20 Returns no later than July 15 2022.

Vintage Unstructured Strapback Hat Baseball Cap Boralex Canada Power Company Electricity

Excel Formula Income Tax Bracket Calculation Exceljet

Product Pricing Calculator Handmade Item Pricing Worksheet Profit Margin Labor Materials Cost Pricing Excel Business Template

Cryptocurrency Taxation In Canada In 2022 Cryptocurrency Capital Assets Goods And Services

Pin By Maths Made Easy On Mock Papers By Mme Sumome Landline Phone Paper

What Is A Good Rate Of Return On Investments Reverse The Crush In 2022 Investing Investing Money Income Investing

Know Your Worth Then Add Tax Taxreliefcenter Inspiration Preparing For Retirement Best Money Saving Tips Tax Prep

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

Fbr Called For Income Tax Proposals For 2021 2022 Budget

2021 2022 Income Tax Calculator Canada Wowa Ca

The Ultimate 5 Property Rental Real Estate Template Excel Template For Landlords Rental Property Template

What Is Cryptocurrency How To Calculate Cryptocurrency Canadian Tax In 2022 Cryptocurrency Investing In Cryptocurrency Bitcoin

Forget Everything You Ve Heard About What Is A Good Cap Rate Investment Property In 2022 Real Estate Investing Real Estate Investing Rental Property Real Estate Tips

Rental Property Owner Management Kit Rental Owner Printable Business Manager Landlord Tool Rental

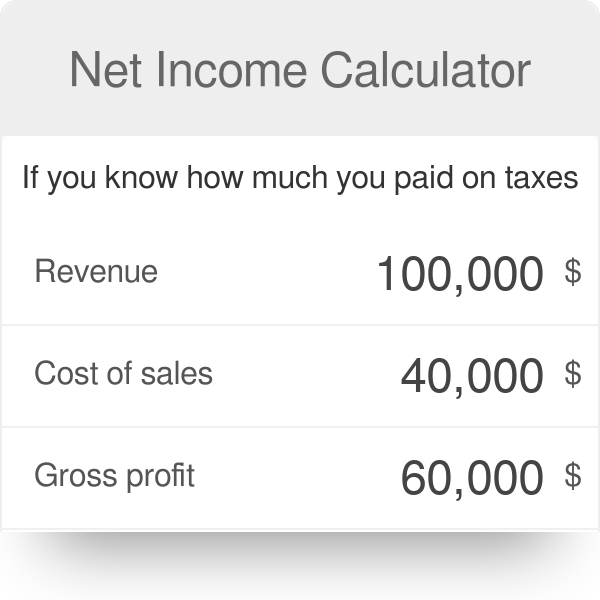

Net Income Calculator Find Out Your Company S Net Income

Simple Tax Calculator For 2021 Cloudtax

How To Register And Open A Cra My Account In 2022 Personal Finance Lessons Energy Saving Tips Accounting